INVESTMENT POLICY

INTRODUCTION

1. Introduction

- The purpose of this investment policy is to establish priorities and guidelines regarding the investment management of the County's inactive moneys (as defined in Section 135.31 of the Ohio Revised Code), or other such funds as designated by the investing authority which will be considered as the Portfolio or Portfolios. Such priorities and guidelines are based upon eligible investments pursuant to Section 135.35 of the Ohio Revised Code (ORC), and prudent money management.

- This investment policy, dated July 18, 2024, has been approved by the investing authority and the County Investment Advisory Committee.

- The investment policy, dated July 18, 2024, is a revision of an originally approved policy, dated May 20, 2020.

- Section 135.35 ORC [totally or partially] may be referenced in describing eligible investments. In some sections, the policy places further limits upon the use of eligible investments or investment transactions.

The County Treasurer is the investing authority and is referred to as the "Treasurer". The County Investment Advisory Committee is referred to as the "IAC".

Return To Top

INVESTMENT OBJECTIVES

2. The investment objectives of the County, in priority order, include:

- A. Compliance with all Federal and State laws

- B. Safety of principal • Safety of principal is the most important objective of the County. The investment of County funds shall be conducted in a manner that seeks to ensure the preservation of capital within the context of the following criteria:

CREDIT RISK

- Credit risk is the risk of loss due to the failure of a security issuer to pay principal or interest, or the failure of the issuer-to make timely payments of principal or interest. Eligible investments, pursuant to Section 135.35 ORC, affected by credit risk include certificates of deposit, commercial paper, bankers' acceptances, corporate obligations, obligations of the State of Ohio or any of its agencies, and obligations of any Ohio political subdivision. Obligations of the State of Ohio and any of its agencies, obligations of any Ohio political subdivision, including Franklin County or other public entities affiliated with or supported by the County, shall be referred to as municipal obligations.

- Credit risk will be mitigated by diversifying assets by issuer as follows:(1) limiting the investment to 15% of the total portfolio, calculated at the time of purchase, in obligations of political subdivisions or issuances referred to as municipal obligations, including issuances of Franklin County or other public entities affiliated with or supported, directly or indirectly, by the County; (2) except for issuances of Franklin County or other public entities affiliated with or supported by the County, limiting the investment of any one municipal issuer to 5%, calculated at the time of purchase; (3) except for issuances of Franklin County or other public entities affiliated with or supported by the County, the Treasurer will only purchase municipal obligations with a credit quality rating in one of the two highest categories issued by a nationally recognized statistical rating organization; (4) maintaining adequate collateralization of certificates of deposit or other bank deposit accounts, pursuant to the method as determined by the Treasurer. The Treasurer reserves the right to limit the amount or percentage of State of Ohio debt issuances and other obligations of Ohio political subdivisions including Franklin County debt issuances, or other public entities affiliated with or supported by the County, to be held in the investment portfolio.

MARKET RISK/INTEREST RATE RISK

The market value of securities in the County's portfolio will increase or decrease based upon changes in the general level of interest rates. The effects of market value fluctuations will be minimized by (1) maintaining adequate liquidity so that current obligations can be met without a sale of securities; (2) diversifying maturities; (3) diversifying assets.

- Liquidity - The portfolio shall remain sufficiently liquid to meet all current obligations of the County. Minimum liquidity levels [as a percentage of the average portfolio] may be established to meet such current obligations. The Treasurer may elect to separate the County's total investment fund balance into a liquidity portfolio, comprised of various short-maturity investments, such as bank deposit accounts or other cash equivalent obligations.

- Yield - The portfolio shall be managed to consistently attain a market rate of return throughout budgetary and economic cycles. For purposes of this policy, the market average rate of return may be defined as the average yield of a constant maturity U.S. Treasury obligation (CMT), calculated by the Federal Reserve Bank of New York, over a specific time. As an added reference, the Treasurer may elect to compare the portfolio's average yield over a specific period to the average yield of one or more CMT calculations. The Treasurer may additionally elect to include other benchmarks, provided that such benchmarks are similar in nature to the maturity limitations and asset characteristics of the County's portfolio. Whenever possible, and consistent with risk limitations and prudent investment management, the Treasurer shall seek to augment the return or yield [of the portfolio] through the implementation of active portfolio management strategies.

Return To Top

AUTHORIZED INVESTMENTS

- U.S. Treasury Bills, Notes, and Bonds; various federal agency securities including issues of Federal National Mortgage Assn. (FNMA), Federal Home Loan Mortgage Corp. (FHLMC), Federal Home Loan Bank (FHLB), Federal Farm Credit Bank (FFCB),

Government National Mortgage Association (GNMA), and other agencies or instrumentalities of the United States. Eligible investments include securities that may be "called" [by the issuer] prior to the final maturity date. Any eligible investment may be purchased at a premium or at a discount. All federal agency securities will be direct issuances of federal government agencies or instrumentalities.

- Up to forty per cent of the county's total average portfolio (as calculated using a method approved by the County Treasurer) in either of the following investments:

- Commercial paper notes issued by companies incorporated under the laws of the United States; specific limitations apply as defined under Section 135.35 (A)(8) ORC.

- Bankers' acceptances issued by any domestic bank rated in the highest category by a nationally recognized rating agency; specific limitations apply as defined under 135.35 (A)(8) ORC.

- Certificates of deposit from any eligible institution mentioned in Section 135.32 ORC. Collateralization requirements apply as provided for under Section 135.37 ORC. The Treasurer shall determine whether such collateral will be accepted under the pooling method, or whether such collateral will be specifically pledged to the Treasurer through a third-party pledging arrangement.

- No-load money market mutual funds rated in the highest category by at least one nationally recognized rating agency, investing exclusively in the same types of eligible securities as defined in Division A(l), A (2), or (6) of Section 135.35 ORC and repurchase agreements secured by such obligations.

- Repurchase agreements with any eligible institution mentioned in section 135.32 ORC, or any eligible securities dealer pursuant to division (J) of this section, except that such eligible securities dealers shall be restricted to primary government securities dealers. Repurchase agreements will settle on a delivery versus payment basis with collateral held in safekeeping by a third-party custodian as determined by the Treasurer. The market value of securities subject to a repurchase agreement must exceed the principal value by an amount as defined under the Ohio Revised Code. The Treasurer reserves the right to require an additional percentage of collateral securing such repurchase agreements. Prior to the execution of any repurchase agreement transaction with an eligible dealer, a master repurchase agreement will be signed by the Treasurer and the eligible dealer(s). The Treasurer will determine the selection of the custodian, including the method of delivery and safekeeping of collateral.

- Securities lending agreements with any eligible institution mentioned in 135.32 ORC.

- The State Treasurer's investment pool (STAROHIO), pursuant to Section 135.45 ORC, and any other eligible investment alternative sponsored or offered by the Treasurer of the State of Ohio.

- Bonds and other obligations of the State of Ohio, various issuances of the agencies of the State of Ohio, and obligations or debt issuances of any Ohio political subdivision, including Franklin County or other public entities affiliated with or supported by Franklin County. All such debt issuances, except for obligations of Franklin County or other public entities affiliated with or supported by Franklin County, or political subdivisions within Franklin County, will have a minimum credit rating in one of the two highest categories, or the equivalent, by a nationally recognized rating agency, at the time of purchase. The highest rating category of a nationally recognized rating agency may include a numeric or arithmetic symbol denoting a sub-category. The Treasurer may purchase unrated obligations from political subdivisions within Franklin County or from other public entities affiliated with or supported by Franklin County, in part or totally, if such obligations are deemed to provide a beneficial economic impact upon the County and such obligations are additionally approved by the Investment Advisory Committee prior to purchase. Without limiting the generality of the previous sentence, the purchase of obligations from political subdivisions within Franklin County during a state of emergency, as declared by the Governor of the State of Ohio, shall be deemed to provide a beneficial economic impact upon the County and such purchase does not require the approval of the Investment Advisory Committee. The purchase of obligations, deemed to provide a beneficial impact upon the County, may be purchased directly by the Treasurer as private placements.

- Notes issued by corporations that are incorporated under the laws of the United States and that are operating within the United States; specific limitations apply as provided for under Section 135.35(A)(9) ORC.

- Debt interests rated at the time of purchase in the three highest categories by two nationally recognized standard rating services and issued by foreign nations diplomatically recognized by the United States government. All interest and principal shall be denominated and payable in United States funds. The investments made under division (A)(l0) of Section 135.35 ORC shall not exceed in the aggregate two per cent of the County's total average portfolio. The County Treasurer shall determine the method of calculation when ascertaining the maximum limit of two per cent of the County's total average portfolio. The investing authority shall invest under division (A)(l0) of this section in a debt interest issued by a foreign nation only if the debt interest is backed by the full faith and credit of that foreign nation, there is no prior history of default, and the debt interest matures not later than five years after purchase. For purposes of division (A)(l0) of this section, a debt interest is rated in the three highest categories by two nationally recognized standard rating services if the debt interest itself or the issuer of the debt interest is rated, or is implicitly rated, at the time of purchase in the three highest categories by two nationally recognized standard rating services.

- As authority established by ORC 135.80, Linked Deposits provided that at the time any such linked deposits are placed, purchased, or designated, the combined amount of investments of public money of the county in linked deposits of any kind is not more than twelve percent of the county’s total average investment portfolio, as determined by the treasurer; specific limitations apply as defined under section 135.61 (A) ORC.

PROHIBITED INVESTMENTS, PROHIBITED TRANSACTIONS, AND OTHER

LIMITATIONS

- Final maturities in excess of five years, except as provided under Section 135.35(() ORC.

- Derivative securities, as defined in Section 135.35 (B) ORC.

- The use of leverage.

- The issuance of taxable notes for the purpose of arbitrage.

- Other prohibited investments or transactions as defined in Section 135.35 ORC.

The Treasurer shall determine the method of calculating the average portfolio when percentage limitations must be determined for the investment in certain eligible investments, such as commercial paper and bankers’ acceptances and corporate obligations.

Return To Top

CONTINUING EDUCATION

-

The Treasurer shall require designated employees who are assigned investment responsibilities to attend continuing education classes or seminars each year. At a minimum, such designated persons shall earn the minimum amount of hours or credits as specified under law. The County will bear the cost of continuing education courses for the Treasurer and employees of the Treasurer.

Return To Top

SAFEKEEPING AND CUSTODY

-

The Treasurer shall appoint a custodian for the safekeeping of the County's investment assets. Such investment assets-will be delivered to, and held in safekeeping by, a custodian bank that is qualified and experienced in providing custodial services to institutional investors, specifically public entities. The Treasurer shall enter into an agreement with such custodian in which the duties and responsibilities of the custodian are defined. The County's designated investment advisor will have no custodian responsibilities or authority except that the designated investment. advisor will be authorized to provide trade instructions directly to the custodian with copies of such transaction advice provided to the Treasurer or the Treasurer's designated staff. Securities held in safekeeping by the custodian will be evidenced by a monthly statement which will include an inventory of investment assets and details of any investment transaction(s) for the period and income credited to the account. The custodian may safekeep the County's securities in (1) Federal Reserve Bank book entry form; (2) Depository Trust Company (DTC) book entry form in the account of the custodian or the custodian's correspondent bank: or (3) non-book entry (physical) securities held by the custodian or the custodian's correspondent bank. All securities transactions will settle using standard delivery-vs.-payment (DVP) procedures. The records of the custodian shall identify such securities as investment assets of the County. Under no circumstances will the County's investment assets be held in safekeeping by a broker/dealer firm, or a firm affiliated with, or acting on behalf of a broker/dealer firm.

Return To Top

REPORTING

-

The Treasurer shall maintain a detailed inventory of the investment assets of the County. A description of each security will include the issue/issuer, cost [purchase cost/current book value], par value [maturity value], maturity date, settlement date of purchased or sold securities, and any coupon [interest] rate. The investment report will also include a record of all investment transactions. The Treasurer will maintain a monthly portfolio report(s) and issue such portfolio report(s) to the IAC, The Board of County Commissioners, and the State Treasurer, detailing the inventory of all securities, transactions for the period, and income received. The report shall also include the yield of each security, and the average-weighted yield and average-weighted maturity of the total portfolio.

Any premium paid over par may be amortized equally during the life of the investment as a deduction from semi-annual or annual interest payment(s) received each year, or such premium paid may be amortized at the final maturity date of the investment.

Any discount from par will be recognized at the final maturity date of the investment.

Return To Top

INVESTMENT ADVISORS, QUALIFIED DEALERS AND FINANCIAL INSTITUTIONS

-

The County is authorized to retain the services of an investment advisor, pursuant to Section135.341 (D) ORC. Upon request, the investment advisor will attend such meetings and will discuss all aspects of the County's portfolio, including market conditions or

economic factors affecting the County's investments. If approved in an Investment Advisory Agreement with the County Treasurer, the investment advisor will make investment decisions on a discretionary basis regarding the investment of County funds and/or manage the portfolio of the County, including the execution of investment transactions. Such investment decisions are limited to eligible investments as defined under Chapter 135.35 and the County's approved investment policy. Under no circumstances will brokers or broker/dealer firms act as an investment advisor or in a similar capacity as an investment advisor, either directly or indirectly, if such broker/dealer participates in transaction business (purchase and sale of securities) with the Treasurer or the Treasurer's investment advisor.

The Treasurer will approve the list of eligible broker/dealers through which the Treasurer, the Treasurer's Designee, or the Treasurer's designated Investment Advisor will execute investment transactions. The Treasurer along with the input of the Investment Advisor will determine the criteria to be considered when recommending a broker/dealer firm for approval by the County Treasurer. The County's Investment Advisor will execute investment transactions on a "best price and execution basis" and will evaluate broker/dealers based upon criteria which may include, but not limited to, the following guidelines:

1. Knowledge of relevant state statutes regarding eligible investments of public entities

2. Institutional fixed-income experience

3. Execution capability/timely delivery of securities

4. Access/participation in new-issue federal agency securities

5. Regular and competitive participation in the secondary market

6. Access to inventory

7. Timely confirmation of trades prior to settlement date.

8. Filings with FINRA which include State of Ohio registration

In addition to the above guidelines of the Investment Advisor, the broker/dealer will provide annually the most recent audited financial statements and be subject to periodic requests form the County Treasurer for current Focus Reports.

Such eligible broker/dealers may include Ohio financial institutions, primary securities dealers regularly reporting to the New York Federal Reserve Bank, regional securities firms, or broker dealers licensed with the Ohio Department of Commerce, Division of Securities, to transact business in the State of Ohio. Eligible broker/dealers and financial institutions are defined in Section 135.35 (J)(l) ORC.

All persons or entities transacting investment business with the Treasurer are required to sign the approved investment policy as an acknowledgment and understanding of the contents of said policy.

Return To Top

SALE OF SECURITIES PRIOR TO MATURITY

-

Pursuant to Section 135.35 (E) ORC, securities may be "redeemed or sold" prior to maturity under the following conditions:

1. To meet additional liquidity needs

2. To purchase another security to increase yield or current income

3. To lengthen or shorten the portfolio's average maturity (duration)

4. To realize any capital gains and/or income

5. To adjust the portfolio's asset allocation

Such transactions may be referred to as a "sale and purchase" or a "swap." For purposes of this section, redeemed shall also mean "called" in the case of a callable security.

Return To Top

PROCEDURES FOR THE PURCHASE

AND SALE OF SECURITIES

-

Upon execution of an investment transaction (purchase or sale), the Treasurer's investment advisor will provide transaction advice, evidencing such transactions to the Treasurer's designated staff. A facsimile transmission or other form of communication of the transaction advice(s) will also be sent to the designated custodian bank to provide the required information necessary to settle the trade(s).

Confirmation advice, representing the purchase and/or sale of securities [including price], will be issued by the eligible broker/dealer and sent to the investing authority. Copies of such advice will be sent to the investment advisor.

Return To Top

STATEMENTS OF COMPLIANCE

-

This investment policy has been approved by the investing authority and filed with the Auditor of State, pursuant to 135.35 (K)(l) ORC. The County Investment Advisory Committee has additionally approved the investment policy.

All brokers, dealers, and financial institutions executing transactions initiated by the Treasurer or the Treasurer's investment advisor are required to sign the approved investment policy: Investment policies, signed by such broker/dealers will be filed with the Treasurer. The County's investment advisor shall be registered with the Securities and Exchange Commission and will possess public funds investment management experience, specifically in state and local government investment portfolios, as provided in for under 135.341(D). The investment advisor will be required to sign the approved investment policy.

Any amendments to this policy will be filed with the Auditor of State [Attn: Clerk of the Bureau, P.O. Box 1140, Columbus, OH, 43216-1140] within fifteen days of the effective date of the amendment.

Return To Top

ETHICS AND CONFLICT OF INTEREST

-

Members of the Investment Advisory Committee and employees of the Treasurer's Office involved in the investment process shall refrain from personal business activity that could conflict with the proper execution and management of the investment program, or that could impair their ability to make impartial investment decisions. Members of the Investment Advisory Committee and employees of the Treasurer's Office involved in the investment process shall disclose any material interests in financial institutions with which they conduct business within the County. They shall further disclose any large personal financial/investment positions that could be related to the performance of the investment portfolio. All employees and investment officials shall be familiar with the requirements of the Ohio Revised Code and County policy regarding gifts and favors and shall act accordingly.

Return To Top

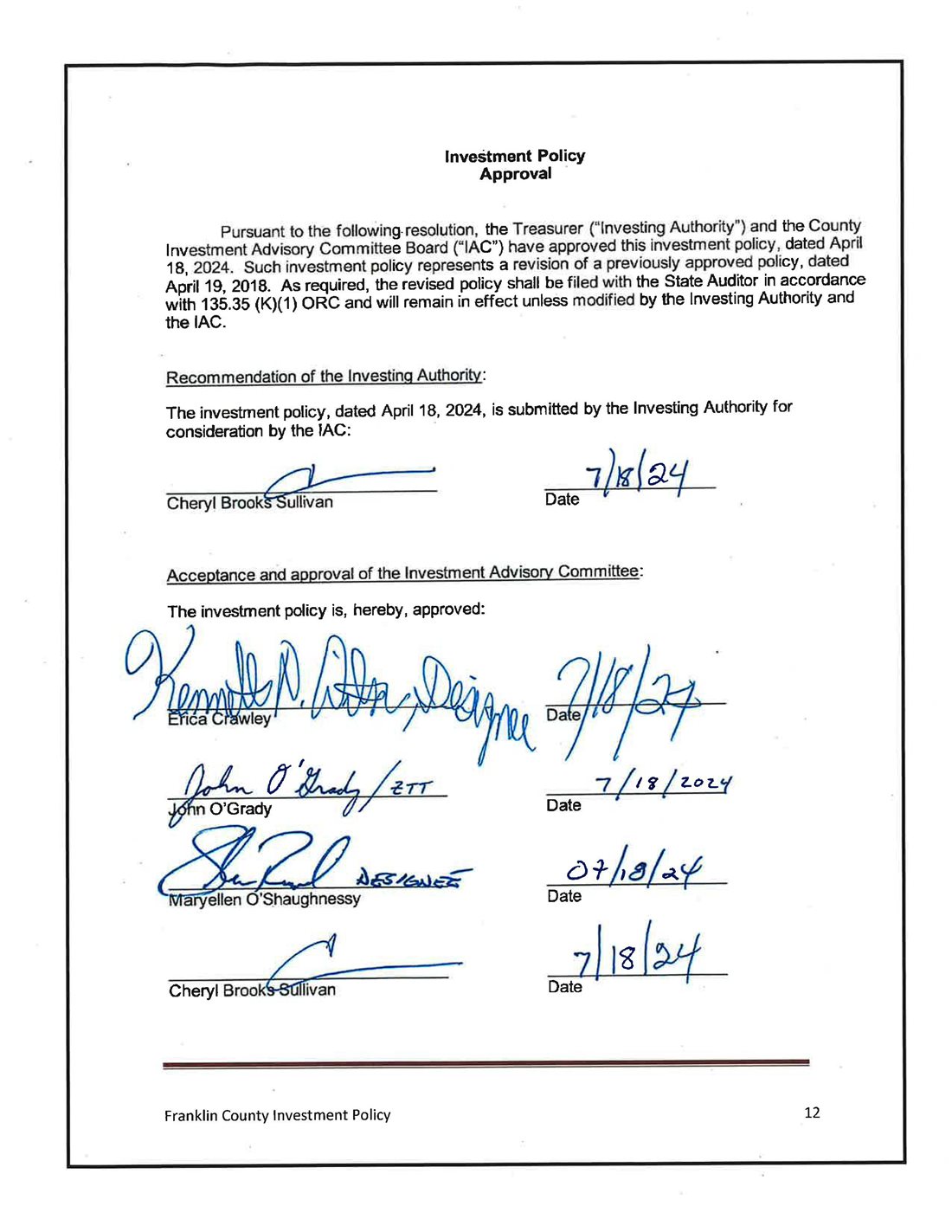

INVESTMENT POLICY APPROVAL

Pursuant to the following resolution, the Treasurer ("Investing Authority") and the County Investment Advisory Committee Board ("IAC") have approved this investment policy, dated April 19, 2018. Such investment policy represents a revision of a previously approved policy, dated April 27, 2017. As required, the revised policy shall be filed with the State Auditor in accordance with 135.35 (K)(l) ORC and will remain in effect unless modified by the Investing Authority and the IAC.

Return To Top